This year we supported their first endorsed ocean conservation programme called IMMA. It aims to support the restoration of the balance of life in the ocean through the identification of Important Marine Mammal Areas (IMMAs)

Read MoreFrom January 1st 2022, France implements compulsory and automatic VAT reverse charge mechanism on import for businesses importing goods in France.

Read MoreOn 14 January 2022, the Italian Revenue Agency (AGENZIA DELLE ENTRATE) issued the answer no.26/2022 to an official request (Istanza d'Interpello) concerning the VAT/Customs regime following the BREXIT of a British flagged yacht currently in Italian territorial waters.

Read MoreWe are pleased to announce that our 6th Fiscal meeting will take place on the 21st of September at the prestigious Hotel Hermitage the evening before the start of the Monaco Yacht Show 2021.

Read MoreSOS Yachting is a pleased project partner of the Ocean Assist program which the Water revolution foundation is developing to check, endorse, promote and report on projects taking transformative actions for improving the health of our beloved oceans.

Read MoreThe French Tax Authorities have recently confirmed that VAT is due on advanced provisioning allowance (APA) for charters starting in French/Monegasque territorials waters. This is already in place for charters starting in Italy.

Read MoreFinally on 15th June 2021 the Italian Tax Authorities published - with provision n. 151377- the form for electronic declaration for the purposes of the ICE (Italian Commercial Exemption).

Read MoreSOS Yachting will be participating to the Palma Superyacht Show from the 3rd-6th of June. You will find us at stand #SY26 in the Varadero Area. A great opportunity to meet our Operations manager Alessia Manfredi from our Spanish office

Read MoreSOS Group is proud to announced that they have been appointed the official distributor the FLYN products. Based on the AIS positioning system, FLYN has developed a Tracking system that follows the yacht from the beginning to the end of the cruise and calculates the time

Read MoreSOS Yachting is proud to announce the launch of the new edition of the VAT Smartbook.

For six years we have launched this Smartbook aiming to give our clients a “smart” and handy overview of fiscal rules and regulations that govern the Superyacht charter sector in the EU.

Read MoreThe Union status of a yacht will be kept if a yacht was located within the EU territorial waters on midnight of December 31st, 2020. If the yacht was out of the EU on/after January 1, 2021 is brought back to the EU and fulfills the conditions to be considered under the ‘Returned Goods Relief’, then it can be declared to Customs as such and preserve its VAT status or import the yacht.

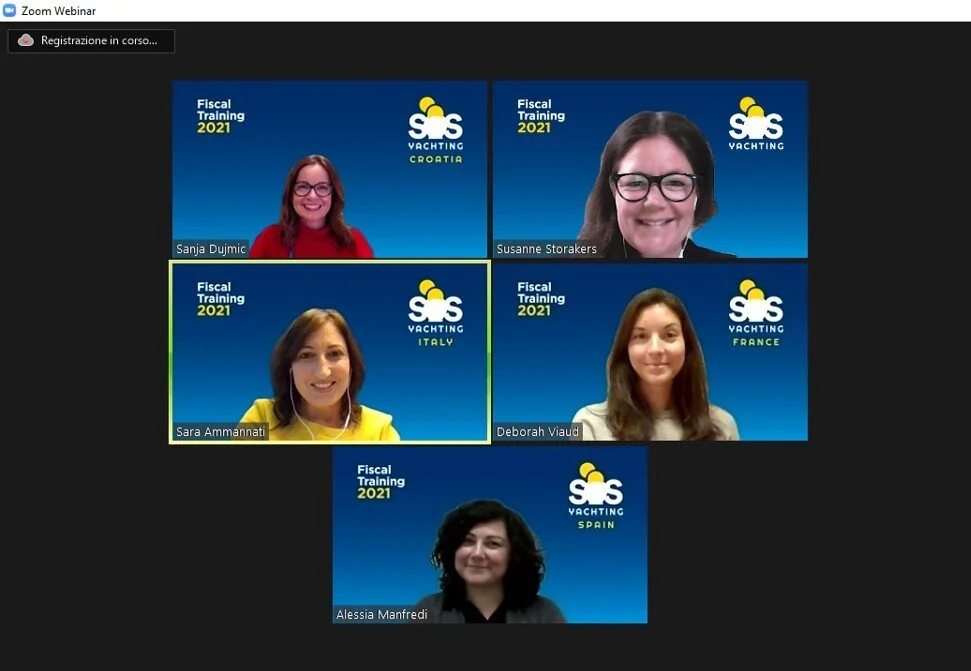

Read MoreDuring the past three weeks our Operation Managers from Croatia, France, Italy and Spain have hosted 13 online fiscal trainings presented to our loyal clients. SOS Yachting is organising fiscal trainings to its clients in Europe and United States at the beginning of the season each year to meet, exchange opinions and give an updated on the latest local regulations.

Read MoreMany of you will have heard lately about Melilla and Ceuta, and the Canary Islands, two Spanish regions which are outside the VAT territory. Everybody knows where the Canary Islands are, but for the ones who do not know where to find Melilla and Ceuta just look for them on the Northern Coast of Africa, in front of Gibraltar.

Read MoreWe guide you thought the process.

How does the French Commercial Exemption work?

SOS Yachting’s Fiscal trainings ready for you and your team!

Read MoreWe guide you thought the process.

The VAT registration in Spain takes longer than in other countries. Do you know why?

Stay tuned for more!

Read MoreThe Ministry of the Sea, Transport and Infrastructure has communicated the decision to stop issuance of Croatian cabotage license to all NON EU flagged vessels with the registered length below 24 meters, and a consequence of this decision is suspension of all charter operations in Croatia for vessels that fall under this category.

Read MoreGiven the health crisis linked to the Covid-19 and the limited chartering opportunities in 2020, the French Tax Authorities stated that, in 2020, for yachts that have not been able to operate commercially (charters or transport contracts) as well as for yachts that have been operated commercially in 2020 and did not comply with the 70% rule, the following would apply:

Read MoreThe SOS Yachting team is taking some time off ☀️😉 We would like to wish all our clients, colleagues and friends Happy Holidays!

Read More